Investors

A strong and high-performance company

Since 1999, ALTEN has been listed on the Paris Stock Exchange and has benefited from a strong financial position as well as a growth strategy that has been managed carefully.

Our company has been expanding worldwide in line with its business model and its top-of-the-range positioning, while reconciling our profit margin policy with our will to tackle our clients’ technological challenges ahead.

REGULATED INFORMATION

LAST FINANCIAL PUBLICATIONS

FINANCIAL CALENDAR

Find here the next financial communication dates of the ALTEN Group.

FINANCIAL KEY FIGURES

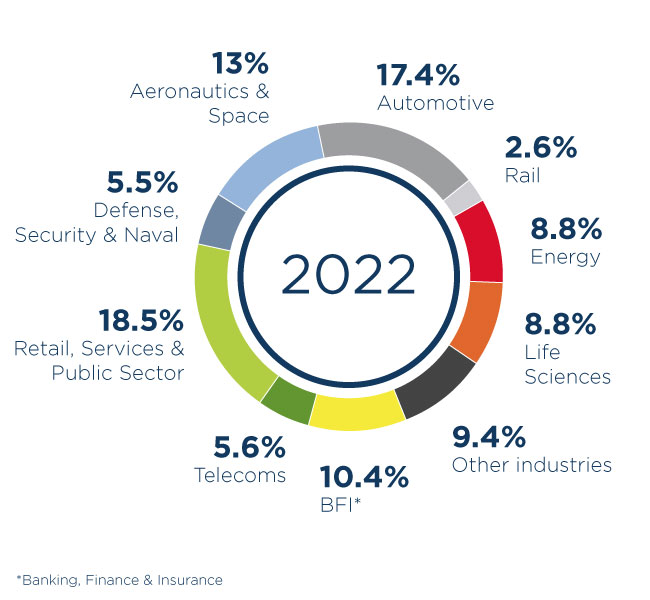

Turnover breakdown by main sectors

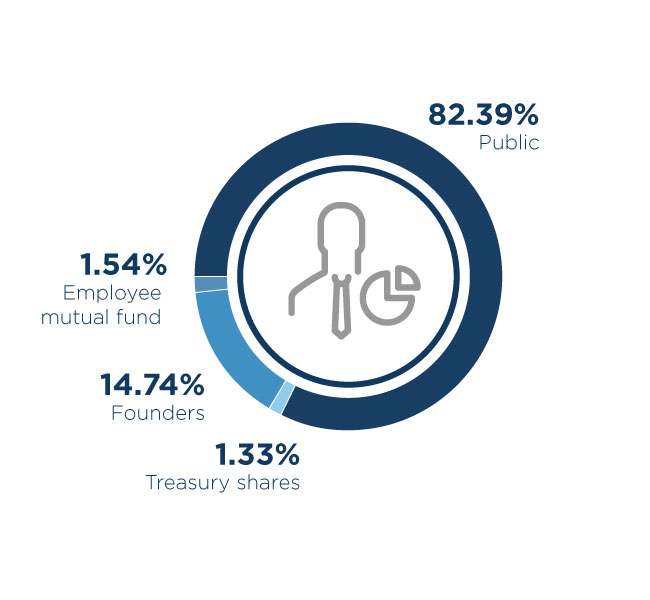

Distribution of ALTEN capital

FEW KEY FIGURES

Governance

Simon AZOULAY

Chairman and Chief Executive Officer

Mr. AZOULAY is a graduate of Supélec.

After having managed the R&D laboratory at Thalès, he founded ALTEN in 1988 with 2 associates who are also engineers.

Emily AZOULAY

Director

Mrs. AZOULAY has worked for the ALTEN Group since ALTEN SA was formed in 1988. Among other positions, she was Sales Manager and Head of Administration and Finance. Her involvement with the ALTEN Group no longer extends beyond her capacity as a Director.

Mrs. AZOULAY is member of the Remunerations and Appointments Committee of ALTEN SA.

Mrs. AZOULAY has worked for the ALTEN Group since ALTEN SA was formed in 1988. Among other positions, she was Sales Manager and Head of Administration and Finance. Her involvement with the ALTEN Group no longer extends beyond her capacity as a Director.

Jean-Philippe COLLIN

Independent Director

Mr. COLLIN has more than 40 years of international experience in several industry sectors: Automotive, IT, Consumer Electronics and Pharmaceuticals in senior management positions in companies such as IBM, Valeo, Thomson, PSA and Sanofi. He is an expert in the implementation of change and transformation strategies at the level of internal organizations, structuring processes and corporate governance. He holds positions as director or non-employee advisor in companies and organizations such as Grant Alexander, Jicap, CAN, HR Flow, Silex and Innov +.

Mr. COLLIN is member of the following ALTEN SA committees: Audit, Remunerations & Appointments, CSR.

Marc EISENBERG

Independent Director

Mr. EISENBERG began his career as a management consultant. In 1986 he formed a cost-reduction consultancy in France, which has since become a European leader in its field and of which he was Operating Manager until 2012. He remains a major shareholder to this day. He also sat on the Nanterre Employment Tribunal from 1995 to 1999 and the Bobigny Commercial Court from 2000 to 2001.

Mr. EISENBERG began his career as a management consultant. In 1986 he formed a cost-reduction consultancy in France, which has since become a European leader in its field and of which he was Operating Manager until 2012. He remains a major shareholder to this day. He also sat on the Nanterre Employment Tribunal from 1995 to 1999 and the Bobigny Commercial Court from 2000 to 2001.

Maryvonne LABEILLE

Independent Director

Mrs. LABEILLE is Chair and Executive Officer of LABEILLE CONSEIL, a consulting firm she created in 1993. Mrs. LABEILLE works with French and international companies as Advisor in Human Resources and Talent Acquisition, more specifically in the recruitment and integration of their executive directors.

Mrs. LABEILLE holds several duties with SYNTEC: both Vice President of SYNTEC CONSEIL and Director of Fédération SYNTEC that associates consulting, engineering and digital activities. Mrs. LABEILLE is also elected member of CCI Paris and Director of ODIS, a centre for applied research and social intelligence.

Mrs. LABEILLE is Chairman of the following ALTEN SA committees: Remunerations & Appointments, CSR.

Aliette MARDYKS

Independent Director

Mrs. MARDYKS has held operational and functional positions in the Airbus Group. She originated the accounting integration project at the Group within a Shared Service launched in November 2008 covering 4 of the Group’s main countries (France, Germany, United Kingdom and Spain). Mrs. Mardyks has not held a position at Airbus Group since the end of 2016.

Mrs. MARDYKS is chairman of the Audit Committee of ALTEN SA.

Mrs. MARDYKS has held operational and functional positions in the Airbus Group. She originated the accounting integration project at the Group within a Shared Service launched in November 2008 covering 4 of the Group’s main countries (France, Germany, United Kingdom and Spain). Mrs. Mardyks has not held a position at Airbus Group since the end of 2016.

Mrs. MARDYKS is chairman of the Audit Committee of ALTEN SA.

Jane SEROUSSI

Director

Mrs. Jane SEROUSSI is a business leader. She has successfully created her own brand and she has been her company’s Managing and Financial Director since its inception. The Group is expanding in France and abroad through an exclusive network of branded boutiques.

Mrs. Jane SEROUSSI is a business leader. She has successfully created her own brand and she has been her company’s Managing and Financial Director since its inception. The Group is expanding in France and abroad through an exclusive network of branded boutiques.

Philippe TRIBAUDEAU

Independent Director and Lead Director

Mr. TRIBAUDEAU has more than 25 years of experience in the Corporate Finance, Investment Banking and M&A fields. He is authorised by the Financial Services Authority in the United Kingdom. He spent several years at Merrill Lynch – Bank of America in the United Kingdom, where he served as First Vice-President.

Mr. TRIBAUDEAU is member of the Audit Committee of ALTEN SA.

Mr. TRIBAUDEAU has more than 25 years of experience in the Corporate Finance, Investment Banking and M&A fields. He is authorised by the Financial Services Authority in the United Kingdom. He spent several years at Merrill Lynch – Bank of America in the United Kingdom, where he served as First Vice-President.

The Executive Committee meets at least once a month. It is made up of the Chairman and Chief Executive Officer and Deputy Chief Executive Officers.

It analyses the sales and financial performance, defines the development strategy, sets targets, and implements operational measures

Simon AZOULAY

Chairman and Chief Executive Officer

Bruno BENOLIEL

Chief Operating Officer responsible for Finance, Legal and Information Systems

Pierre MARCEL

Deputy Chief Executive Officer in charge of ALTEN Germany

Olivier GRANGER

ALTEN Managing Director responsible for International scope 1

Pierre BONHOMME

Executive Vice President ALTEN France, UK and North America

Stephane OUGIER

Executive Vice President ALTEN France and Solutions subsidiaries and Eastern Europe

Gualtiero BAZZANA

Executive Vice President ALTEN France for Enterprise Services & Telecoms

Pascal AMORE

Executive Vice President responsible for ALTEN in Asia

Guillaume JOUËT

Group Chief Human Resources Officer

ASSESSMENTS

Shareholder’s area

In this space dedicated to the Group’s shareholders, you will find useful information to follow your ALTEN actions and upcoming financial events.