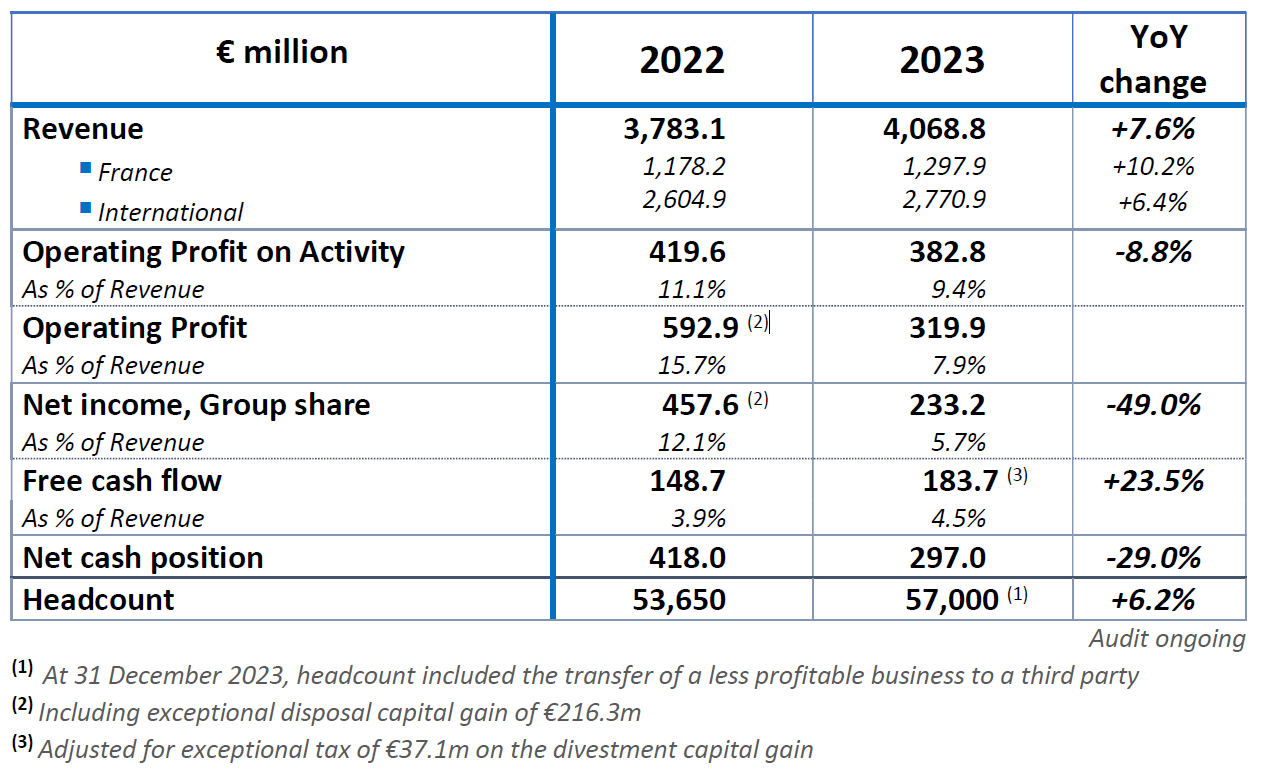

2023 Annual Results

SATISFACTORY ORGANIC GROWTH: +9%

OPERATING MARGIN ON ACTIVITY: 9.4% OF REVENUE

5 ACQUISITIONS OUTSIDE FRANCE

BUSINESS IN 2023: +7.6%

Business growth reached 7.6%: 10.2% in France, 6.4% outside France. On a like-for-like basis and at constant exchange rates, business growth reached 9.0% (+10.2% in France and 8.4% outside France).

The Civil Aeronautics, Automobile and Defence & Security sectors enjoyed strong growth.

France, Southern Europe and the Benelux saw strong organic growth in 2023 (> 10%) while growth in other geographies slowed during 2023.

OPERATING MARGIN ON ACTIVITY: 9.4% OF REVENUE

Operating profit on activity came to €382.8m (9.4% of revenue). In 2022, the operating margin stood at 11.1% of revenue but was not normative.

In 2023, the consolidation of less profitable companies, a satisfactory activity rate levels but lower than in 2022 which was an exceptional year; increases in structuring expenses as well as an unfavourable calendar effect, explain the decline in operating margin compared with 2022.

OPERATING PROFIT: 7.9% OF REVENUE

Operating profit on activity came to €319.9m (7.9% of revenue). It includes €32.3m in non cash share-based payments and €30.6m in non-recurring costs (including €18.5m costs and earn-outs linked to acquisitions and €9.1m in restructuring costs).

NET INCOME, GROUP SHARE: 5.7% OF REVENUE

The financial result amounted to €0.2m. After taking into account €86.9m of tax expenses, Group net income came to €233.2m.

NET CASH POSITION: €297.0m/GEARING: -14.6%

Cash flow (excluding IFRS16) came to €381.6m (9.4% of revenue) in line with operating profit from activity.

The Working Capital Requirement increased €91.1m owing mainly to organic growth and a slight increase in DSO. Capex remained low (€20.6m, i.e. 0.5% of revenue).

Tax paid (€123.7m) included exceptional tax on a capital gain on an investment carried out in 2022 amounting to €37.1m. Reported free cash flow came to €146.6m, i.e. 3.6% of revenue; adjusted for this exceptional item, it would have increased by €183.7m, i.e. 4.5% of revenue, up 23% compared with 2022.

After taking account of net financial investments (-€216.8m), dividends paid (-€51.4m) and other financial flows (+€0.5m), net cash came to a positive €297.0m at end-2023.

ALTEN self funded internal and external growth and its investment capacity remains intact (gearing: -14.6%).

EXTERNAL GROWTH: 5 ACQUISITIONS ABROAD

ALTEN carried out 5 acquisitions in 2023:

- In the US/Canada: a company specialised in software testing (revenue: €18m, 185 consultants)

- In Poland: a company specialised in IT & Telecommunication services (revenue: €19m, 350 consultants, including 50% external)

- In India/US/Germany: a company specialised in IT development and engineering services (revenue: €9m, 500 consultants)

- In Spain/Germany: a company specialising in aeronautical engineering (revenue: €7m, 130 consultants)

- In Japan: a company specialising in embedded software (revenue: €41m, 720 consultants)

ALTEN withdrew at the end of November in India, from an unprofitable business in the field of network and telecom infrastructures (revenue: €17.8m, 1,480 consultants).

OUTLOOK FOR 2024

ALTEN generated satisfactory business growth in 2023, in line with its guidance. As expected, organic growth slowed during 2023, reflecting normalisation of the economy. This slowdown is likely to be confirmed during the first half of 2024, before a probable rebound in the second half. ALTEN should therefore generate satisfactory organic growth in 2024 and continue to pursue its targeted external growth strategy.

Next release: 25 April after market closing: Q1 2024 revenue

About ALTEN

For more information: www.alten.com/investors/ Journalists’ details: alten@hopscotch.fr

As a European Leader in Engineering and Technology Consulting (ETC), ALTEN carries out design and research projects for Technical and IT divisions of major clients in industry, telecoms and services. ALTEN’s stock is listed in compartment A of the Euronext Paris market (ISIN FR0000071946); it is part of the SBF 120, the IT CAC 50 index and MIDCAP100, and is eligible for the deferred Settlement Service (SRD).

APPENDIX TO PRESS RELEASE

Definition of alternative performance measures and reconciliation with IFRS standards

The ALTEN Group uses alternative performance measures especially selected to follow up on its operational activities. The Group has chosen these measures as they supply additional information allowing the users of periodic financial information to have a comprehensive understanding of the Group’s performance. Such alternative performance measures are complementary to IFRS standards.

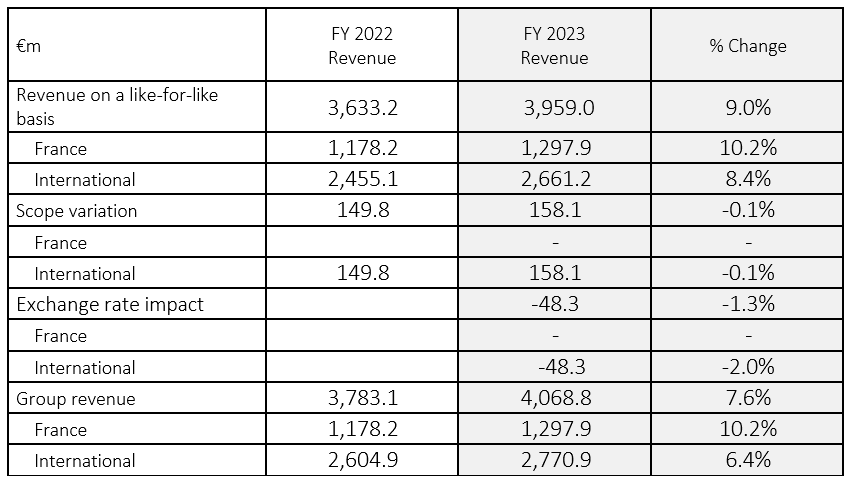

Revenue growth on a like-for-like basis (i.e. organic growth)

Growth on a like-for-like basis (and constant exchange rate) is calculated excluding the effects of exchange rate variations and the variations of the consolidation scope on a chosen period.

Exchange rate impacts are measured by converting the revenue of the period with the average exchange rate from the previous period.

Scope variation impacts are measured excluding acquisitions, revenue of the period and for transfers, revenue of the previous period, in order to create a scope which is identical to the previous period.

This alternative measure enables to identify the real performance of the Group in terms of activity on the chosen period.

Business trends in 2023

Operating Profit on Activity

Operating Profit on Activity is the operating income before taking into account the costs on share-based payments, results from significant transfers of assets, goodwill impairment, as well as other significant and uncommon elements considered as miscellaneous fees and operational activities.

Since payments on share-based compensation have noticeable heterogeneous annual changes, the tables included in our financial statements show the operational performance of the Group and make it possible to compare with previous or selected periods.

Net cash position (or net debt)

Net debt – as defined and used within the Group, stands for cash flow and assimilated elements of cash flow less gross financial debt (bank loans and other assimilated financial debts). This measure is called ‘net cash position’ when the amount of cash flow or assimilated elements is higher than the financial debt; conversely, it is called ‘net debt’.

Free cash flow

Free cash flow corresponds to net cash flow from operating activities minus net operating investments and net cash flow from financing activities related to payments of leasing debts.